Apple upsets the app advertising cart

Apple, in the name of privacy, makes a grand move against ‘tracking’. But what will it actually mean? (Part 1)

Apple’s new iOS update has a new feature called App Tracking Transparency, which it expects all apps running on their platform to implement, and is set to significantly impact digital advertising.

This is Part 1, Part 2, Part 3 and Part 4.

There is a lot of complexity in how the wider digital advertising ecosystem works, and with this new measure, quite a lot of uncertainty. Apple for one has not revealed a lot of detail, although it has been quite vocal as to why (more on that in the next post).

Apple has technical levers it can pull, and a lot can be simply enforced through technology. But some of what they claim they will want will require them to keep an eye on the wider ecosystem. To what extent will other players abide by Apple’s rules? Neither can we be sure how users will respond.

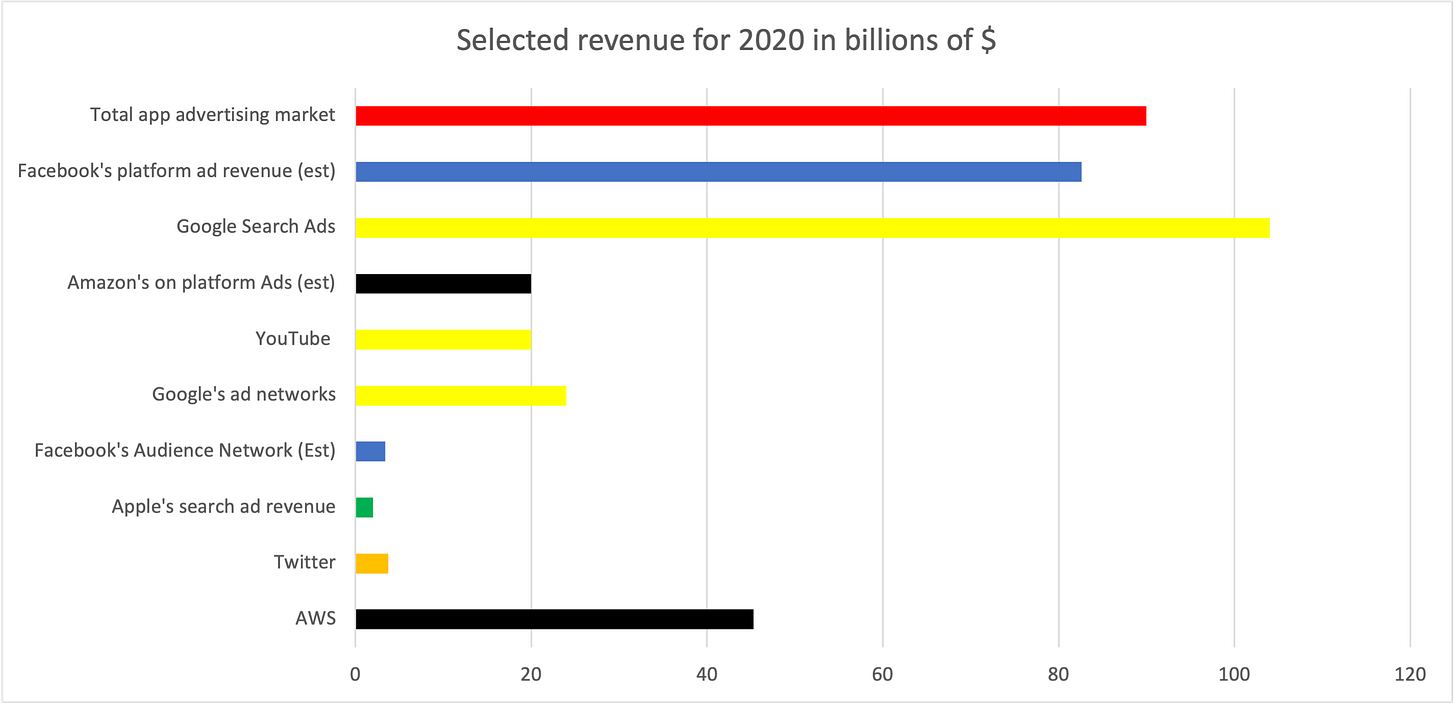

What is at stake? Advertising inside apps is a $90 billion market and growing fast. Both Google’s (32% y-o-y) and Facebook’s (46% y-o-y) digital advertising growth just shattered expectations for Q1 2021. And Apple had a stellar quarter itself. Yet a year ago, in Q1 2020, Tim Cook revealed that there are already a total of 1.4 billion active iOS devices worldwide.

In the US, 47% of all smartphones are iOS, over 110 million devices. In the UK, the most advanced e-commerce and digital advertising market in the west, 51% of smartphones are iOS. In Europe the figure sits at 30%. In the world’s largest smartphone market, China, “only” 21% of smartphones run iOS.

This post will look at some of the technical detail and speculate as far as we know what the impact might be on a granular level. If you are not a technologist, a digital ad person or a policy nerd, you might find this post a bit tedious. But I had to do this close-up look before I could start speculating about the macro.

The next post(s) will unpack some of the wider and more interesting implications, for the platforms, for publishers, for retailers, for privacy, for the future business model of the internet, for market concentration, for society and ask - should government intervene?

What is Apple about to do?

The App Tracking Transparency framework will ask iOS users of an app a simple question. Can the app they use track them? Yes or no. Considering the simple binary option, it is expected that most users will opt not to be tracked on most apps.

The first thing to note is what Apple means by “tracking”. Apple has not released a lot of detail, and much is still unclear.

“Tracking”

Apps and websites, by virtue of having to function, need to “track” what users do on them. So when Apple talks about tracking it means a specific kind of tracking that’s now prohibited. Apple explicitly prohibits apps and web sites, from disparate companies, from sharing data for the purpose of advertising.

It is the… “linking user or device data collected from your app with user or device data collected from other companies’ apps, websites, or offline properties for targeted advertising or advertising measurement purposes” …which will be prohibited.

So what will not be impacted?

Let’s start with a simple example. Did you leave items in your iOS Ebay app cart without finishing checkout? When you return, Ebay can “remember” that you had not completed the buying and the items can still be there.

Can you favourite a Tweet using the Twitter iOS app, and using the IFTTT service, have it sent to a Google Spreadsheet? Here we have an instance of the sharing of data between your iOS app and a different company’s service. But it’s not for advertising purposes. So it should be ok.

What about saving an Audible book in the Amazon app to a list and it shows up in your Audible app? Here we have another instance of the sharing of data between apps. And it’s also not for advertising purposes. And more crucially, Amazon owns Audible. It’s not another company. Even when if it was for advertising purposes it would be ok. (More on this huge loophole, and its possible effects in the next post.)

Let’s say you are an app owner or developer. Can your app send data to an analytics service (say Mixpanel), to see how users use your service? As long as it’s not used for advertising measurement purposes, then yes you can. Apple does not really need to police this much either. They simply won’t give the analytics service the IDFA (the Apple device identifier) that makes more granular device tracking on other digital properties - and therefore for ad purposes - possible.

Apple explicitly makes two more exceptions. “When the data broker with whom you share data uses the data solely for fraud detection, fraud prevention, or security purposes. For example, using a data broker solely to prevent credit card fraud.”

A sensible exception considering the amount of fraud out there. Pooling fraud data (a card number that’s been used fraudulently) across the internet makes it much harder for fraudsters.

The next exception may raise the eyebrows of those that hoped Apple was limiting tracking (or surveillance) in the name of stopping unbridled commerce (capitalism) on the internet.

Apple also does not want to limit the ability to track users for the purposes of building and checking credit profiles, even if users ask not to be tracked. So Apple says: “When the data broker is a consumer reporting agency and the data is shared with them for purposes of (1) reporting on a consumer’s creditworthiness, or (2) obtaining information on a consumer’s creditworthiness for the specific purpose of making a credit determination.”

A lot of in-game and other purchases are made via apps. And at times credit makes the wheels of commerce turn. Apple takes a cut from some of the revenues, plus some retailers won’t want to have shops on iOS if they can not offer credit.

What is no longer allowed?

But what if you are a retailer (not on the Amazon or Facebook platforms) and rely on advertising? Then it’s likely your ads are also running on an ad network embedded inside apps and websites. With this change, you can still run your ads inside the apps, but you will not be able to target them nearly to the extent you did before, for probably most iOS users.

Why is it that retailers not on platforms will lose some of their ability to target ads? Well, ad networks sit across many websites and apps. They provide both distribution for ads and “share data” to build profiles of users to target. I use the scare quotes, because although ad networks track and report which website or web page a device has visited, this information is usually centralised, and not exposed in its raw form to a member of the network. It is abstracted using statistical guesswork as targeting parameters like “male”, “London”, and “Arsenal supporter”.

Why use an ad network? Very many websites and apps do not tend to have large enough audience sizes (called reach in the industry) on their own to justify an advertiser spending time to advertise on them alone. A problem that’s more acute if your data is not granular enough to allow for narrow targeting. Even when they do have reach, many websites and apps simply do not have the troves of data (nevermind machine learning) that Facebook or Google has to enable detailed targetting.

How do ad networks build a profile of users to target? By knowing a device’s approximate location, and which websites and apps a device visits, a guess can be made as to the identity and interests of the device owner - so-called behavioural targetting. This data is often enriched by combining it with other datasets.

Currently, all this matching activity of disparate digital properties is based on device identifiers, IDFA on the Apple platform. IDFA can link a journey from a link in an app, to a website, to a device. Without knowing which apps iOS users use and which websites they visit, how often and from where they do so, the picture ad networks are able to form becomes vaguer.

What if you are an “ordinary” publisher, say the Daily Mail, the Guardian, the Mirror or a vertical like Planet Rugby? The relevancy of the ads you will be able to run on your website or app will be affected since the ad networks you use won’t have much data on many iOS users as before. Many users that land on your site and app, will just be that, an undifferentiated user. You will have to show many more ads to get a click. Expect ad prices to fall.

Now Facebook and Google do run ad networks themselves called Facebook Audience Network, Google Ad Sense, Google Ad Manager and AdMob (which incidentally Apple lost out on to Google in a bidding war in 2009). With them, publishers can offer the tech behemoths’ far richer targeting parameters but on their own properties. (Facebook, in general, seems to have best profiles due to the richness of meaning they can extract from their social network)

This part of Facebook and Google’s ad business will be significantly impacted, as iOS apps for users that refused permission will not be able to run the targeted form of these network’s ads. Facebook does not break out the revenue it makes from its network. But Jounce Media estimated, that pre-covid, that Facebook’s Audience Network would generate about $3.4 billion in gross revenue in 2020. (Since then Facebook has reported bumper increases in ad revenue.)

Facebook’s overall revenue for 2020 ended up being $86 billion. So while Facebook’s Audience Network makes a lot of money (in the region of Twitter’s total take of $3.72 billion for 2020), it’s probably less than 5% of Facebook’s overall revenue.

For Google, the revenue from its ad networks is several times this number. In 2020 that was $23 billion. But its overall revenue was over $180 billion, of which Search Ad revenue was $104 billion, and YouTube almost $20 billion. And bear in mind Google relies far less on ad revenue from iOS than from Android users. For Facebook, it’s the other way around. It is more reliant on iOS (Instagram was only available on iOS initially).

“On Platform” app ads

When you are advertising inside the Facebook app on iOS, inside Google Search and the YouTube iOS app, or for that matter using Amazon’s ads on iOS it is a very different story.

Inside the big platforms, ads are a part and parcel of the service. Facebook, for example, knows a lot about its users from its social network itself. (Studies have shown, that only based on what users like on Facebook, their race and sexuality can be determined with an over 80% accuracy.)

And in terms of Apple’s rules, when it comes to sharing data for advertising between Facebook and Instagram, or Google Search, Shopping and YouTube, and of course between Amazon and the streaming site Twitch - they are considered one company. So advertisers will have more options than publishers and retailers to still finely target their advertising to a large batch of iOS users.

Not that advertising On Platform with Facebook and Google will have no problems from this new iOS tracking regime. It would be naive to think that neither Facebook and Google did not further complement their existing rich profiles of users with data they got from their app use. That supplementary data for many iOS users will now be gone.

But also, attribution to the advertisers of some of their iOS users in ad campaigns will become harder. Let’s say the retailer above uses Facebook Analytics to track their Facebook ads that run inside the Facebook iOS app. They can no longer use the IDFA device identifier to track the attribution of campaigns on a granular level to the user actually buying.

This means that if 50 do not track iOS Facebook app users click on the Facebook ad to go to your online shop, and 5 ends up buying, Facebook will not have data on which 5 did so. In fact, unlike before it would not know some of the 5 had bought at all.

That’s because Apple now recommends apps use the Apple replacement API (SKAdNetwork) for conversion tracking. It will allow for some conversion data to be passed back “at the campaign level”. At most, it will mean you could measure when a conversion took place right away. In other words: somebody saw the ad clicked and bought right there. Apple will let Facebook know which ad caused a conversion.

But up to now, Facebook, because it could track the device, would also count a conversion, when a person clicked, and then went back to buy up to a week later (A behaviour advertisers consider normal, especially for big-ticket items that require “consideration”.)

While some conversions now won’t show, for those that do, you will no longer see the gender, age range of the buyer, or their approximate location (Facebook gives this information up to the region or city level at present) in Facebook Analytics. The same type of attribution problem will afflict Google’s ad analytics. Facebook says that to compensate it will run some statistical models to try and estimate the true conversion numbers. Be that as it may, one might expect this degraded attribution might put downward pressure on ad prices.

It’s also worth noting that because Amazon’s ads run entirely in their system and link to products also inside their system, their advertising seems to be not impacted at all. And as Benedict Evans points out, Amazon ads could be raking in as much as $20 billion per year (2020), and it is growing really fast (this Q1 results points at as much as a 73% leap! from a year ago) and already be more profitable than their hugely profitable AWS.

“Retargeting”

It would also seem that (the hugely effective/ useful/ annoying) retargeting (where you visit a product online and then see an ad for it inside an iOS app), using IDFA, would no longer be possible either. Remember it’s actually more unusual for people to see a product in an ad and to buy right there and then.

Some commentators think you will still be able to use Facebook for On Facebook retargeting since it can still track users via their Facebook IDs, (Provided of course the product or page the user interacted with originally was not another iOS app with tracking disabled for that user).

But if you read the wording of Apple’s terms for their service, it would seem that if Facebook allowed its IDs to get around the retargeting issue inside their app for the users that declined tracking they would be in contravention of the spirit of what Apple is now trying to achieve. Something Techcrunch confirmed from an Apple spokesperson. Yes, Apple controls only the IDFA system, but they expect other services not to use other means such as hashed emails to track users.

Machine learning “audiences”

Lastly, it is worth considering how this change will impact Facebook and Google’s machine learning-driven audience tools.

Facebook’s Lookalike Audiences have existed since 2013 and it’s incredibly powerful. Give (via the Facebook pixel on the checkout) Facebook a set of users, say people that bought your product in the UK the last 90 days, and ask it to give you 200,000 most similar Facebook and Instagram users in the UK to target with ads. In tests Lookalikes usually blow even a finely tuned manual selection of demographics and interests out of the water. The only downside for advertisers is they don’t know how Facebook’s algorithm selected the audience to target.

Speak to experts in machine learning and they will tell you that the amount of data points a machine learning algorithm has really matters. This is why Facebook’s Lookalikes have worked so well. Since Facebook will no longer be able to link many of its users to their browsing, shopping and app use, one should expect these Lookalike audiences to be less predictive for some users in the future.